Rising interest rates are placing downward pressure on stocks and bonds.

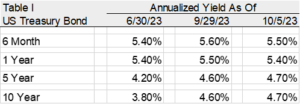

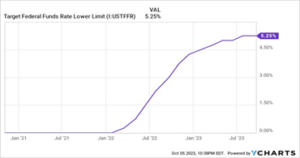

Earlier in 2023 investors were expecting the Federal Reserve Board “FED” to begin reducing rates by the end of 2023. This expectations has been pushed out to 2024. I expect the FED to raise interest rates ¼ point this year, bringing the Fed Funds rate to the 5.50-5.75% range. Inflation is easing but at a slower rate than previously expected. The FED telegraphed clearly interest rates will rise by another ¼ point this year. The FED recently issued its forecast of various economic indicators. Most noteworthy is its Fed Funds rate forecast in 2025 of 3.9%, well less than the 5.50-5.75% range which may prove to be the highwater mark for Fed Funds for this interest rate increase cycle. The stock and bond markets have receded since July due to the rise of oil prices and the 5 and 10-Year Treasury Bond yields (see table I).

Interest Rate Policy (Monetary Policy) typically takes 12-18 months to affect the economy in terms of consumer demand, employment, and economic growth.

The FED commenced raising interest rates 18 months ago. The economy and labor markets have shown to be well more resilient with rising interest rates than history would suggest.

Inflation has declined significantly from its high in June 2022 and is now 3.7% as measured by the consumer price Index “CPI”. Although CPI declined swiftly from 9.1% down to 3.7%, it appears to not be declining as quickly as previously expected. Consequently, the FED shifted monetary policy to “Higher-For-Longer”, driving up bond yields. Higher yields put downward pressure on financial assets including bonds and stocks.

Hamas Attack on Israel – Increasing geopolitical risk; oil prices to rise, and stock prices and bond yields to decline.

History teaches us that markets initially decline when a military conflict occurs. Markets recover as the outcome becomes less uncertain. In this case, a real concern is if the conflict expands and affects oil supplies which is why we believe oil prices will rise. These are the events that are impossible to predict which is why we always recommend clients have sufficient cash and bonds maturing to fund expenses for 3-4 years.

US Stocks are currently valued at a price-earnings “P/E” ratio of 15-16x and include earnings growth of 12% in 2024 and 2025.

Corporate earnings growth estimates will likely come down to the 6-10% level from the lofty 12% level. However, if the US economy dodges a recession, stocks may perform well during the next 1-2 years.

Predicting the future of financial markets is close to impossible.

As the well-known economist John Kenneth Galbraith stated, there are two types of economic forecasters: those who don’t know and those who don’t know they don’t know.

Rich Lawrence August 8, 2023

As always – We recommend only investing in the stock market with a long-term view (3+ years) and having cash available for emergencies and spending needs for the short term 2-4 years.