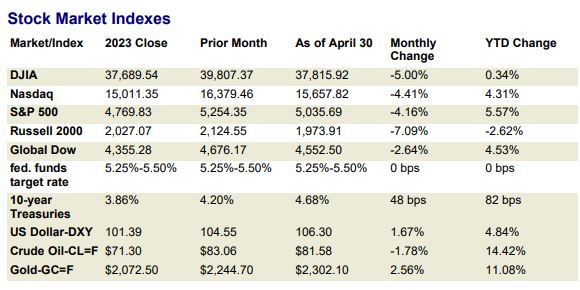

Stocks gave up much of their March 2024 quarter gains in April.

US stocks declined swiftly in April, after five months of positive returns. The culprit is quite simply “INFLATION”.

Investors have been expecting the Federal Reserve “FED” to commence an interest rate reduction cycle with 3 ¼ point cuts in 2024. This is now off the table because inflation is not declining at the rate previously expected. The Consumer Price Index “CPI” and the Personal Consumption Expenditure Index “PCE” both increased in March from February reports. The CPI rose 3.5% in March v. 3.2% in February and the PCE rose 2.7% in March v. 2.5% in February. These inflation data along with an expanding US economy in terms of employment and economic activity provide the FED with no immediate need to reduce interest rates. The bond market is now “pricing-in” only 1-2 ¼ point cuts in interest rates in 2024. Interest rates have a direct effect on stock valuation; the market responded swiftly in April with the US stock market declining 4-5%, and small cap stocks getting hit the hardest being down 7% in April.

The Good News: Corporate earnings are expected to increase 8-12% in 2024 and in 2025.

Real estate and stocks tend to be good inflation hedges. When the cost to build a house rises due to inflation, so does the value of existing homes. As for stocks, inflation moves through corporate income statements with revenue and earnings rising at inflated rates.

2024 Outlook

Positive Tailwinds

- The economy continues to exhibit expansion with Gross Domestic Product “GDP” expected to expand by 2.0% in 2024.

- Corporate earnings as measured by the S&P are expected to grow 10-12% in 2024 and 2025.

- Interest rates are expected to shift downward in the second half of 2024.

- These factors should contribute to an up market in 2024.

Negative Headwinds

- Inflation may not decline as expected, which may prompt the FED to pause reducing interest rates at the pace it previously stated.

- Federal deficit spending continues to put upward pressure on prices by adding to “demand” in the economy.

- If inflation measures do not decline as expected, the market may decline or “correct” in anticipation of the FED delaying reducing interest rates until the end of 2024 or 2025.

Rich Lawrence, CFA May 2, 2024