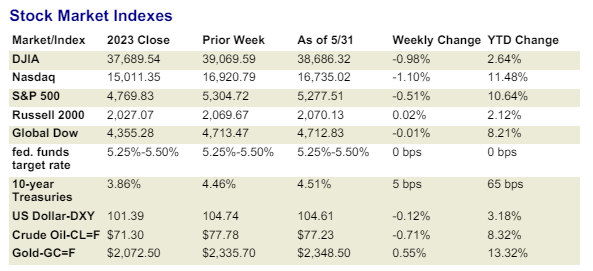

After a red-hot stock market in 2023, 2024 is unfolding to be a more muted market, except for eight of the top ten S&P 500 stocks which are up 16 -35% and Nvidia “NVDA” is up a staggering 131%!

Our client portfolios are more diversified than the S&P 500 Index which is why we closely track the S&P 500 “equal-weighted” index (+5% year-to-date 2024) and the Dow Jones Industrial Average (+3% year-to-date 2024).

Note: The S&P 500 Index is a market capitalization weighted index which means that the largest stocks have an outsized impact to the index. Specifically, the largest 10 stocks represent 35% of the S&P 500 Index.

In contrast, the “equal-weighted” S&P 500 Index is represented “equally” by all 504 stocks in the index. Yes, there are 504 stocks in the S&P 500 Index at the current time.

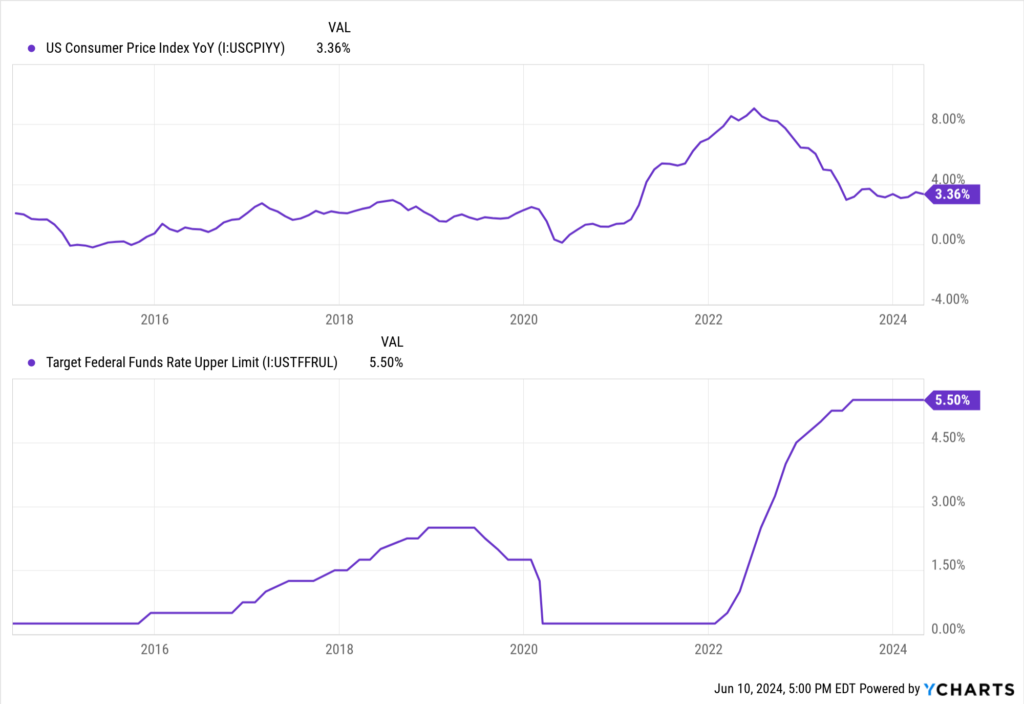

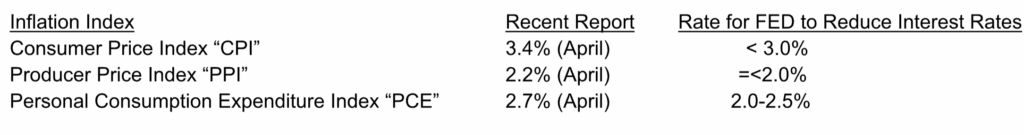

Inflation is causing volatility in the bond and stock markets this year. We are taking the position that the inflation rate is declining and may decline faster than markets expect in the next six to twelve months. The following graph clearly illustrates the trend in the Consumer Price Index “CPI” and interest rates as set by the Federal Reserve Board “FED” during the past 10-years.

A few observations from the graphs above:

- Inflation commenced its sharp ascent in October 2020 when CPI was 1.18% to its 9.06% peak in June 2022.

- The FED mistakenly (in my opinion) kept interest rates at 0.25% flooding the economy with dollars which bid prices up in the economy.

- The FED responded in January 2022 by increasing interest rates rapidly by increasing the federal funds rate to the current 5.25-5.5% target range.

- Inflation declined swiftly from the 9.06% peak to the current 3.38% level. The CPI has been “sticky” for the past few months at the mid 3% level which has given the market cause to question the rate at which the FED will reduce intertest rates.

Why we believe inflation will continue to decline:

- In April 2024 the CPI on a sequential month-to-month basis came in at 0.31% versus the 0.40% market expectation.

- According to the Bureau of Economic Analysis “BEA” retail sales on an inflation adjusted basis declined sequentially in April by 0.4% from March 2024. While this contraction is not dramatic it clearly suggests a weakening in consumer demand.

- Commodity prices are beginning to “rollover”. The S&P GSCI Commodity Index rose a staggering 18% over the past year and recently declined by 7% since April 5, 2024.

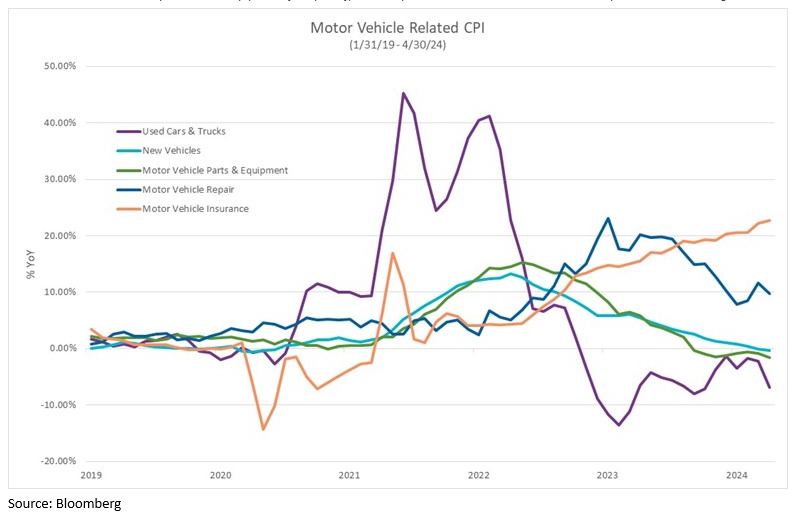

- New and used car prices are stabilizing, while auto insurance prices continue to climb. A sliver of encouraging news with auto insurance: premiums rose a whopping 2.5% in March and 1.8% in April 2024. The table to the right reflects year-over-year price increases (rate %) and not actual prices. With auto parts and equipment prices essentially flat year-over-year I expect the rate at which insurance premium prices to rise to continue its decline in the next 6 months.

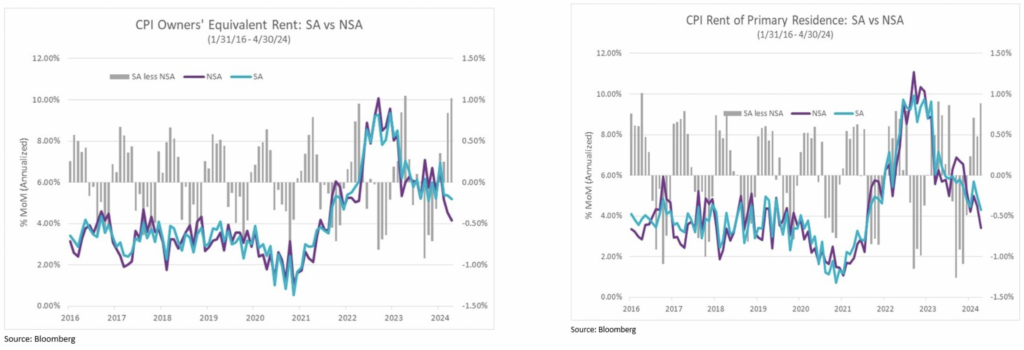

- Shelter is the largest component of inflation indices and includes two components: rent prices for primary residences and the quite opaque owners’ equivalent rent “OER”. Rental price increases have risen from less than 2% in 2020 and 2021 to over 10% in 2023. Rental prices are now rising by less than 4% Y/Y. The US Department of Labor converts home prices to an equivalent rent price. The OER price increase has been declining as well to the 4-5% level.

I expect inflation indices will decline in the next few months. The FED will likely be patient in reducing interest rates, especially if the economy continues expanding, in my opinion.

The Good News: Corporate earnings are expected to increase 8-12% in 2024 and in 2025. Real estate and stocks tend to be good inflation hedges, as evidenced by the recent rise in stock prices and real estate values. When the cost to build a house rises due to inflation, so does the value of existing homes. As for stocks, inflation moves through corporate income statements with revenue and earnings rising at inflated rates.

2024 Outlook

Positive Tailwinds

- The economy continues to exhibit expansion with Gross Domestic Product “GDP’ expected to expand by 2.0% in 2024.

- Corporate earnings as measured by the S&P are expected to grow 8-12% in 2024 and 2025.

- A strong labor market: consumer spending is tied closely to employment.

- Inflation on the retreat

Negative Headwinds

- Inflation does not decline as expected, prompting the FED to pause reducing interest rates at the pace it previously

stated. - Federal deficit spending continues to put upward pressure on prices by adding to “demand” in the economy.

- If inflation measures do not decline as expected, the market may decline or “correct” in anticipation of the FED pushing out reducing interest rates to 2025.

DISCLOSURE:

Opinions about the future are not predictions, guarantees or forecasts. Investing in stock and bond markets have risks that could lead to investors losing money.