First Quarter 2024 – All US Stocks Markets Are Up!

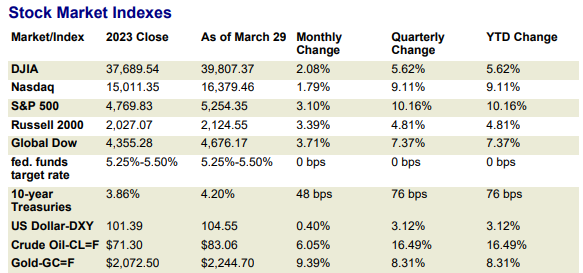

US stocks were up 5-10% during the quarter, depending upon the market index.

As the table below clearly illustrates, the technology-stock heavy S&P 500 Index “S&P” leads the way with a 10.2% gain. However, market performance is beginning to expand to other market segments, with middle-capitalization stocks up 8.5% and large capitalization value stocks up 8.9%. While small capitalization stocks are lagging, up only 5.0% this year, we expect these stocks to perform well later this year when the Federal Reserve “FED” commences cutting interest rates.

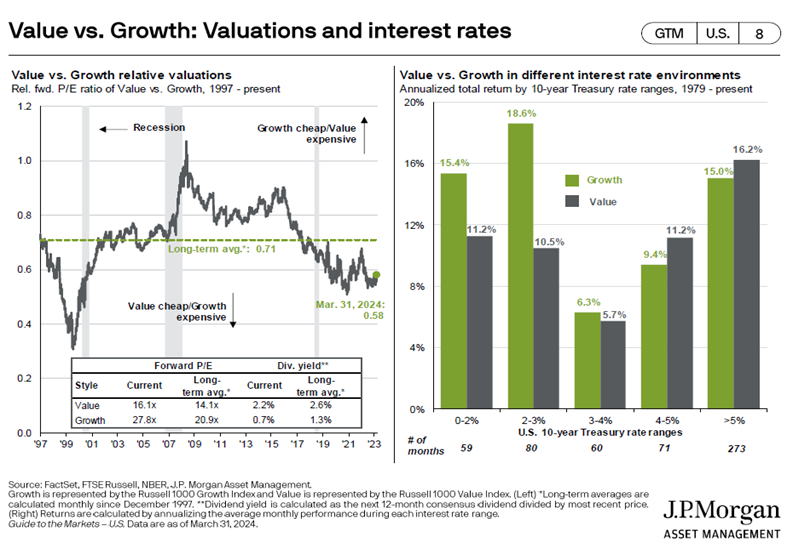

Stock market valuation may appear highly valued when assessing the 21.0x price-to-earnings “P/E” ratio of the S&P. In contrast, the P/E ratio of the broad market is approximately 16.7x, in line with the market’s P/E historical average.

As with performance discussed above, large technology stocks of the S&P skew valuation metrics as well. This is precisely why we construct your portfolio to be well diversified across various market sectors. “Value” stocks are typically priced at P/E ratios well below their “Growth” stock brethren, but whose earnings growth rates are well lower than “Growth” stocks. It all comes down to what we are willing to pay for a $1 worth of earnings growing at x% rate. Value and growth stocks have their “day-in-the-sun” as the chart on the next page illustrates. For the past five years, growth stocks have ruled the market leaving value stocks behind. However, history shows that as interest rates rise, so do value stocks’ P/E ratios. We may be on the cusp of a market shift to value stocks.

2024 Outlook

Positive Tailwinds

- The economy continues to exhibit expansion with Gross Domestic Product “GDP” expected to expand by 2.0% in 2024.

- Corporate earnings as measured by the S&P are expected to grow 10-12% in 2024 and 2025.

- Interest rates are expected to shift downward in the second half of 2024.

- These factors should contribute to an up market in 2024.

Negative Headwinds

- Inflation may not decline as expected, which may prompt the FED to pause reducing interest rates at the pace it previously stated.

- Federal deficit spending continues to put upward pressure on prices by adding to “demand” in the economy.

- If inflation measures do not decline as expected, the market may decline or “correct” in anticipation of the FED delaying reducing interest rates until the end of 2024 or 2025.

With the Presidential election year upon us, various market and political pundits will surely opine how markets perform in election years.

I recently heard one market observer state that the stock market rises 83% of Presidential election years. It is interesting to note that the stock market rose in 17 of the past 20 years or 85% of the years. I suggest that Presidential elections have little to do with stock performance in election years. It is policy differences that may affect markets.

Rich Lawrence, CFA April 3, 2024