I have received a few calls recently inquiring about bonds’ features and yields. This report outlines the basics of bond analysis including contractual obligations, returns and risks. Feel free to call me if you have any questions. Thank you. Rich Lawrence 215-540-0896

The purpose of this report is to clarify bond terms and their economics to investors.

While there are several “yields” associated with bonds, yield-to-maturity (YTM) and yield-to-call (YTC) are the yields that represent the financial return to the investor. A more detailed description of yields will be reviewed later in the report.

Definition: A bond is a debt instrument which is issued to investors by an entity or “issuer” (typically a government or corporation). The issuer promises to pay investors according to a contract, called an indenture, which outlines specifically the terms of periodic payments and final bond principal repayment. If these terms are not met by the issuer, the issuer is in default legally. Bonds may be unsecured, or secured by real estate or equipment in the event the issuer’s cash flow is insufficient to pay interest or repay principal. In essence, investors are “lending” money to issuers and expecting repayment according to the “indenture”.

Bond Features

Face Amount– this is the amount the issuer is obligated to repay at maturity.

Coupon Rate– the percentage rate the issuer pays as a percentage of the face amount. A $1,000 face amount bond with a 4.0% coupon pays the bond holder $40 per year, typically $20 twice a year.

Maturity Date– the date at which the issuer repays the investor the face amount.

Call Date– some bond issues have a call date which occurs prior to the bond’s maturity date. The call feature gives the issuer the right, but not an obligation, to buy the bond back from bond holders at a pre-determined formula.

Required Rate of Return– the rate a buyer requires in order to purchase a bond based on current interest rates and its credit quality.

Risks and Investment Opportunities:

Although bonds are perceived to be less risky than stocks, this is not always the case. Bond prices fluctuate significantly based on the following two primary risks.

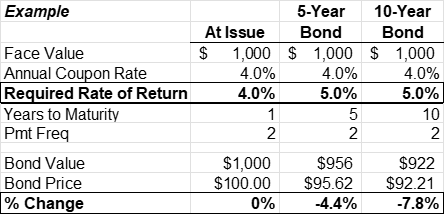

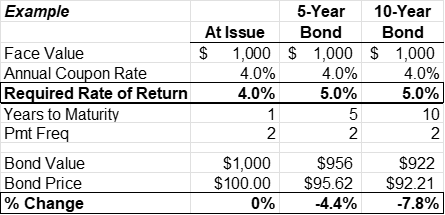

Interest Rate Risk: Interest rate risk is under-appreciated by many investors. Bond prices move in the opposite direction to interest rates. The longer a bond’s maturity, the more sensitive its price is to interest rates. The following example illustrates interest rate risk.

This table clearly illustrates the percentage change of a bond’s value when intertest rates rise. The more years to maturity the greater loss to a bond’s value when interest rates rise. The converse is true; when interest rates decline bond values rise. As presented in the adjacent table, a 1 percentage point rise in interest rates (or the required rate of return) renders a 7.8% decline in the price of the 10-year bond.

Credit Risk/Worthiness: Bonds are priced based on the entity’s credit worthiness and intertest rates at the time of issuance. Most issuers have their bonds rated by a credit rating bureau (Moody’s or Standard and Poor’s). The ratings classify bonds as “investment grade” or “non-investment grade”. Non-investment grade bonds are typically called high-yield or junk bonds.

S&P Ratings

Investment Grade

- AAA Extremely strong capacity to meet financial commitments.

- AA Very strong capacity to meet financial commitments.

- A Strong capacity to meet financial commitments, but somewhat susceptible to adverse economic conditions and changes in circumstances.

- BBB Adequate capacity to meet financial commitments, but more subject to adverse economic conditions.

Speculative grade (non-investment grade)

- BB Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions

- B More vulnerable to adverse business, financial and economic conditions, but currently has the capacity to meet financial commitments.

- CCC, CC, and C All vulnerable to business conditions in order to meet financial commitments.

- D Payment default. Also used when a bankruptcy petition has been made.

Bond Issuers

Governments from around the world

U.S. Government is the largest issuer of bonds. U.S. Treasury bonds are popular because of their high-quality rating and high liquidity (ease with which buyers and sellers can trade without affecting price).

Municipalities

- General Obligation (GO) bonds are backed by the full taxing authority of the municipality issuing the bonds.

Revenue Bonds fund basic municipality services whose repayment is based on the revenue of that service. Water and sewer bonds are typical revenue bonds.

Corporations

- Secured – Secured bonds are collateralized by specific assets, typically real estate, or equipment. If the bond issuing company’s cash flow cannot repay interest and principal to bond holders, they have a legal right to the collateral.

- Unsecured – Interest and principal payments are based on the issuer’s cash flow generating capacity and are not backed by any specific collateral.

Payment Structures

- Coupon Bonds – Coupon bonds have a stated interest rate or coupon the issuer pays on a periodic basis (monthly, quarterly, or semiannually). If an issuer issues a $50 million 5% coupon 10-year maturity bond, the issuer pays its bondholders: $1.25 million every six months; and $50 million at maturity.

- Zero-Coupon Bonds – As the term implies, zero-coupon bonds have no coupon or periodic payments. The issuer promises to repay the principle or face value of the bond at time of maturity. If an issuer issues a $50 million 10-year zero-coupon bond, the issuer has no financial obligation to the bondholders until the maturity date, at which time the issuer must redeem or pay the bond holders $50 million.

Bond Analysis and Valuation

Bond Prices

Par or 100 bond price equals face value.

Premium bond price is greater than par or 100.

Discount bond price is less than 100. In the example above the 10-year bond price is $92.21

Bond Yields

Nominal Yield in our example above, the nominal yield is the coupon rate or 4.0%.

Current Yield coupon rate divided by bond price. In the example above, the 10-year bond’s current yield is 4.3%.

Yield-To-Maturity the “YTM” equals the required rate of return by the bondholder and is the economic yield to the investor. In the example above, the buyer of the 10-year bond buys the bond at a price of $92.21 which will rise to $100 at the time of maturity. The buyer receives this $7.79 gain plus the 4.0% coupon for 10 years. The result: a “YTM” of 5.0%.

Yield-To-Call if a bond has a “call” feature, the yield-to-call “YTC” is calculated so the bond holder will know the bond’s yield if the bond is called or redeemed prior to the maturity date.

Yield-To-Worst The lower of YTM or YTC.

Rich Lawrence, CFA February 7, 2024

DISCLOSURE:

This bond report includes data we believe to be accurate. However, Lawrence Wealth Management (LWM) does not warrant or guarantee its accuracy. Opinions about the future are not predictions, guarantees or forecasts. Investing in stock and bond markets have risks that could lead to investors losing money.