The chart below illustrates various stock market indices’ performance on a 2023 year-to-date basis.

The broad market is up 4-5% this year while the S&P 500 Index is up 16%. The S&P 500 Index is heavily weighted among its top 10 stocks which represent approximately 30% of the index; and is the reason why the index is up substantially more than other indices. The stock market declined in March when Silicon Valley Bank collapsed on March 10, 2023. The Federal Reserve was able to contain a “run’ on banks with various actions; the stock market rebounded to focus on economic growth and inflation.

The economy rebounded in 2023 to the surprise of many investors and economists.

Gross Domestic Product (GDP) expanded 2.0% and 2.1% in Q1 and Q2, respectively. The consensus estimate for Q3 (September) is currently 2.5%, while the Atlanta Federal Reserve Bank is estimating 5.6%. Economic growth appears to be intact for 2023.

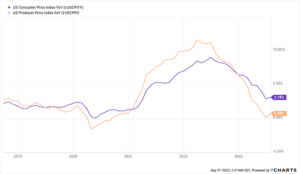

Inflation and labor markets remain in focus as both indicators influence interest rates which influence economic activity and stock prices.

On a positive note, corporate earnings estimates are rising for 2023 and 2024 which should bode well for investor sentiment in coming months.

The stock market’s valuation is in line with historical averages. The broad stock market’s price-to-earnings P/E ratio is approximately 15.7x, slightly less than the 16.8x 25-year average. If the FED is able to navigate slowing down the economy, and thus inflation, without inducing a recession, the stock market should perform well during the upcoming 18 months.

Rich Lawrence August 8, 2023

As always – We recommend only investing in the stock market with a long-term view (3+ years) and having cash available for emergencies and spending needs for the short term 2-4 years.