The Fed paused once again by not raising interest rates: the stock market rises!

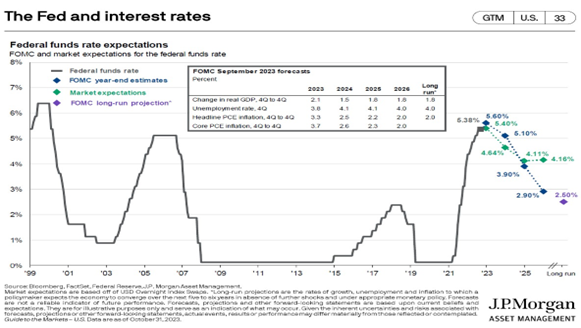

Investors continue to focus on the direction of interest rate policy as promulgated by the FED through its Federal Open Market Committee “FOMC” At the FOMC’s most recent meeting (Oct 31-Nov 1) the committee once again decided to hold interest rates steady by maintaining its Fed Funds Rate Target Range of 5.25-5.50%. Investors now believe the Fed is at the end of increasing interest rates. While the economy continues to expand, signs of a slowing economy and labor market provide investor confidence the FED is close to the end, if not the end, of its interest raising policy; one more ¼ point rise is still a possibility.

Investors now focus on the trajectory of the “DECLINE” in the Fed Funds Rate commencing in 2024.

The graph below shows various market participants estimates of the direction of the Fed Funds Rate in 2024.

We expect the stock market to perform well in the next 18-24 months – notwithstanding the current basket of geopolitical and economic concerns. Our reasons:

- Interest Rates due to decline in the next 12 months as noted above.

- Corporate Earnings are expected to increase 12% in 2024 and 2025.

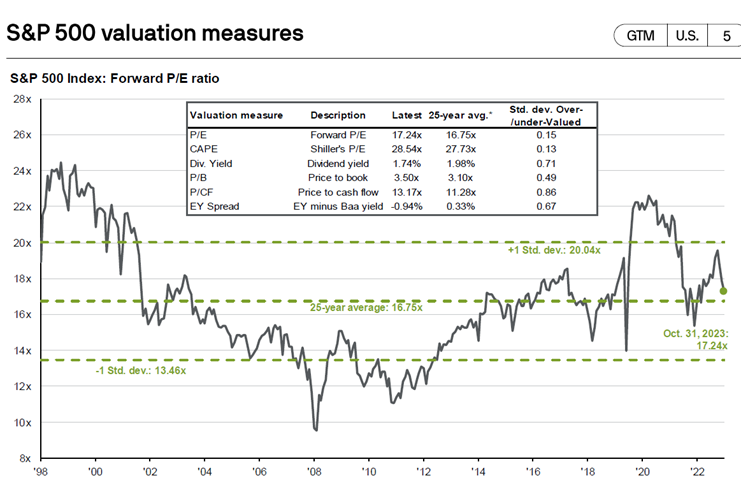

- Stock Market valuation, as measured by the widely used price-to-earnings (P/E/) ratio, is only slightly above its historical average range of 15.0-16.6x.

Our optimism is tempered by the possibility the US economy weakens in 2024 to the point of contraction (recession).

Various economists have been predicting a recession for the past 18 months while the economy remained in expansion due to consumers and government continuing to spend. Recessions are a natural phase of economic cycles, If, a recession unfolds in 2024, inflation will most likely be cut swiftly and pave the road to lower interest rates, setting the stage for the next expansion phase.

Predicting the future of financial markets is close to impossible.

“We recommend only to invest in the stock market with a long-term view (3+ years) and have cash available for emergencies and spending needs for the short term 1-4 years.”

Rich Lawrence November 30, 2023