I think it is timely to reflect on 2023 with only three weeks remaining until we start another year – 2024!

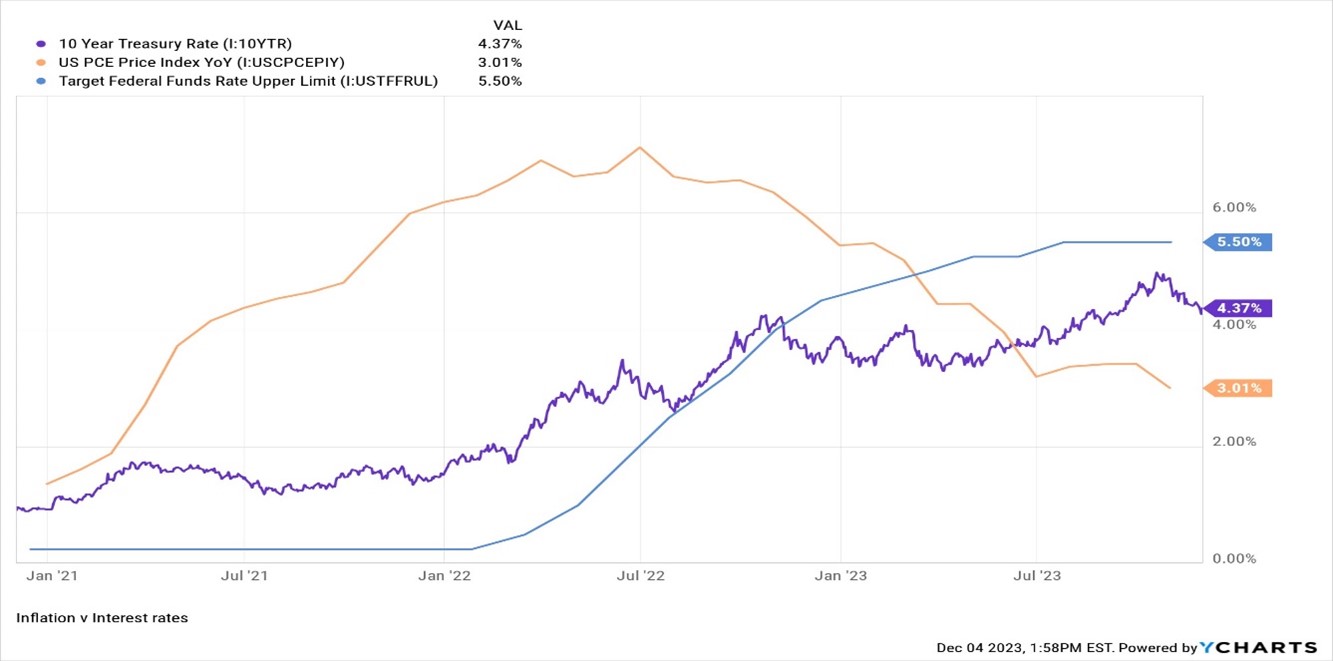

At the beginning of 2023 the inflation rate was declining but still well above 5% on a year over year basis. The Federal Reserve was well on its mission to crack inflation by raising interest rates. The FED increased the Fed Funds Rate to 4.5% by January 2023, up from the very low 0.25% in February 2022, when it commenced its rate tightening cycle. The chart below illustrates the changes of inflation and interest rates. It is quite clear, in my opinion, the FED was late in addressing the rise of inflation most likely due to the economic concerns of COVID. However, the flood of cash the FED injected into the economy is clearly a contributor to the inflationary cycle we are experiencing. The big debate among investors in the first half of 2023 was how high would the FED raise interest rates and by what date. Understandably both economists and investment strategists forecasted a flat line – 0 – GDP for 2023 back in January 2023. The big surprise in 2023; the US economy performed well better than expected. Economists now estimate GDP will be approximately 2.4% in 2023.

As 2024 approaches, inflation continues to decline, and the overall economy is slowing. This is good news for the FED to shift its monetary policy from restrictive (increasing interest rates) to a neutral (stabled to declining interest rates) position.

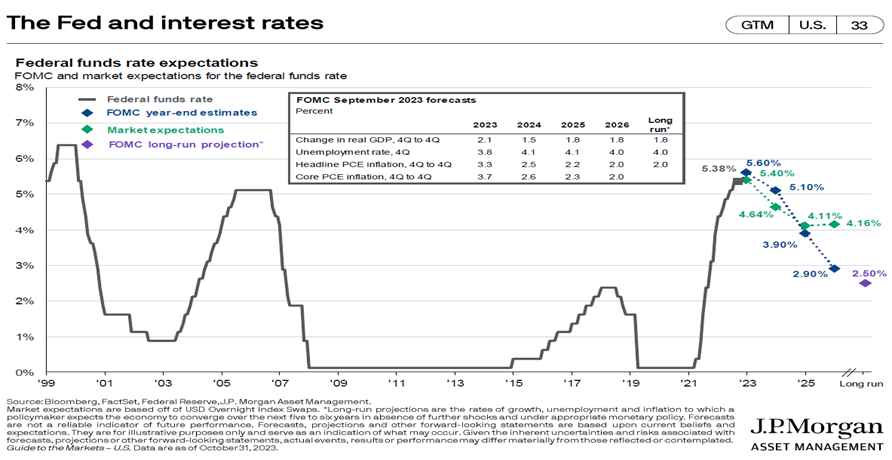

The bond market is “pricing-in” two or three ¼ point cuts in the Fed Funds Rate by June of 2024. The 10-Year Treasury bond yield is now 4.2%, down from 5.0% less than two months ago. This is an extraordinary downward move in rates in such a short amount of time. This downward move in interest rates is the catalyst of the recent rally in stocks and bonds, in my opinion.

The Federal Open Market Committee “FOMC” will meet on December 12-13th, with a press release on the 13th disclosing its unpaid monetary policy and various economic variables forecast. What will the FED do?

I expect the FED will change its rhetoric to a neutral stance, at the very least, and may give an indication that it will consider reducing rates in 2024 if inflation data continue their trend downward to its 2.0% target.

The stock market appears a bit overbought technically at the current time after the recent runup. However I am optimistic about an up stock market in 2024…..

- Interest Rates are due to decline in the next 12 months as noted above.

- Corporate Earnings are expected to increase 12% in 2024 and 2025.

- Stock Market Valuation, as measured by the widely used price-to-earnings (P/E) ratio, is only slightly above its historical average range of 15.0-16.6x.

Our optimism is tempered by the possibility the US economy weakens in 2024 to the point of contraction (recession).

Various economists have been predicting a recession for the past 18 months while the economy remained in expansion due to consumers and government continuing to spend. Recessions are a natural phase of economic cycles, If, a recession unfolds in 2024, inflation will most likely decline swiftly and pave the road to lower interest rates, setting the stage for the next expansion phase.

Rich Lawrence December 31, 2023