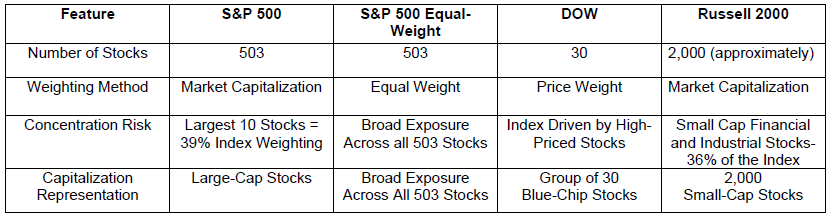

I am using this month’s client note to discuss and contrast a few closely followed U.S. equity indices; most notably the Dow Jones Industrial Average (DOW), the S&P 500 Index (S&P), the S&P 500 Equal Weight Index (S&P equal weight), and the Russell 2000 Index. These indices are used to measure how the stock market is performing across the market’s capitalization (large cap to small cap). No one index is ideal, which is why we follow many indices to measure how our clients’ portfolios are performing relative to “The Market”.

Definitions-

Market Capitalization- Stock price x shares outstanding

Price Weight- Stock price is the basis for weight- see calculation examples below

Examples-

S&P 500- (Market Capitalization Weighted)

The largest 10 stocks rise 10%; the remaining stocks are flat

S&P 500 Index would rise by 3.9% (10% x 39%)

DOW- (Price Weighted)

The Goldman Sachs Group, Inc. – (GS-$791/share as of 10.01.2025)

Merck & Co., Inc. (MRK- $80/share as of 10.01.2025)

DOW Divisor= 0.147

GS rises by 10% in value or $79.10

DOW Points = $79.10/0.147 = 537 DOW Points

MRK rises by 10% in value or $8.00

DOW Points = $8.00/0.147 = 54 DOW Points

As this example illustrates, higher-priced stocks have a greater impact on the Dow Jones Industrial Average than lower-priced stocks. So, if the S&P 500 Index is up 0.2% and the Dow is up 2.0%, one or two DOW stocks may be driving up the index and not indicating a broad uptick of the stock market. A good example of why we check the DOW stocks to see if just a couple of stocks moved higher.

Lawrence Wealth Management LLC “LWM” provides this information based on information believed to be true and accurate. However, LWM does not warrant or guarantee its accuracy. LWM does not provide tax advice. Please consult with your tax advisor for tax advice

Rich Lawrence, CFA October 1, 2025

DISCLOSURE:

Opinions about the future are not predictions, guarantees, or forecasts. Investing in stock and bond markets has risks that could lead to investors losing money.