November 2025

2025 is shaping up to be another

stellar year for stock investors

The Dow Jones Industrial Average (DOW) is up 12%, and the S&P 500 Index is up a whopping 16% through the end of October 2025. The S&P 500 Equal Weight Index is up 7%. Investments in artificial intelligence and ancillary businesses have performed best this year. As we note in this commentary, the earnings growth rate of companies other than the large go-go magnificent 7 is rising in 2026, which should support broader stock performance. While earnings growth and declining interest rates should be supportive of stocks, there are concerns on the horizon as well. Stocks have certainly climbed the proverbial “wall-of-worry” so far in 2025.

Positive Forces-

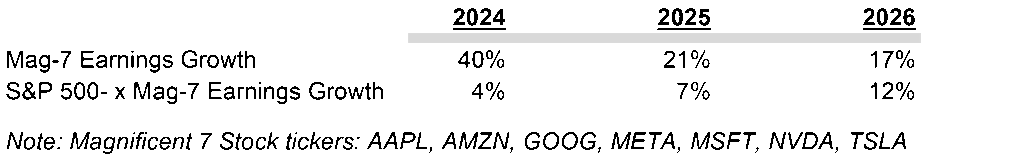

Corporate Earnings Growth- Earnings for the S&P 500 index are expected to grow 10-13% annually in 2025-2027, 25-40% greater than their historical average. This growth rate, however, is driven substantially by the largest seven companies in the S&P 500, fondly referred to as the Magnificent 7 or “Mag-7”.

The earnings growth outlook of the xMag-7 stocks illustrates why stock market participation has expanded beyond just the Mag-7 during the past nine months. We structure our client portfolios to participate in the growth of the Mag-7 while also diversifying among non-Mag-7 stocks.

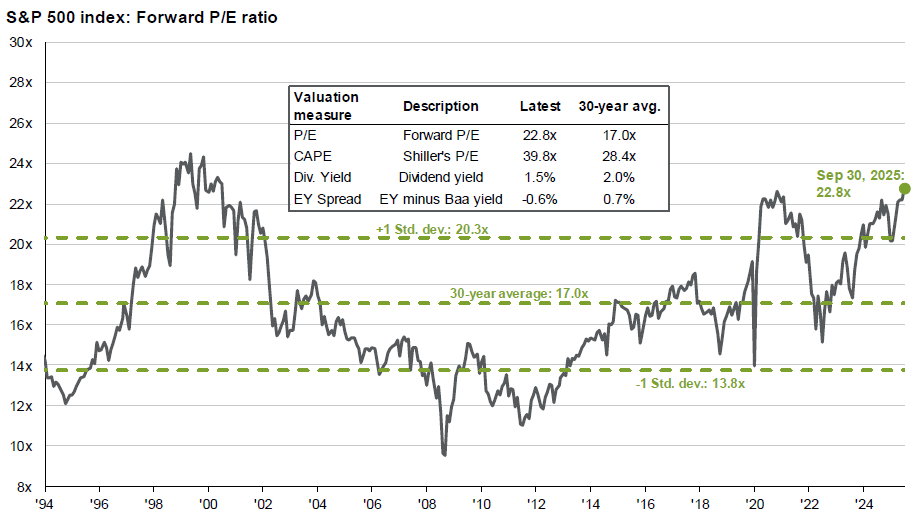

Stock valuation appears high when compared to history, with the price-to-earnings “P/E” ratio of the S&P 500 Index at 23.x. As the following chart illustrates, this 23x P/E ratio is 35% greater than the 17x historical 35-year average.

However, earnings growth for 2025, 2026, and 2027 is 25-40% greater than history. In my opinion, the message is clear: the high P/E ratio is justified by earnings growth, but if there is significant slippage in earnings growth, the stock market will be vulnerable to the downside.

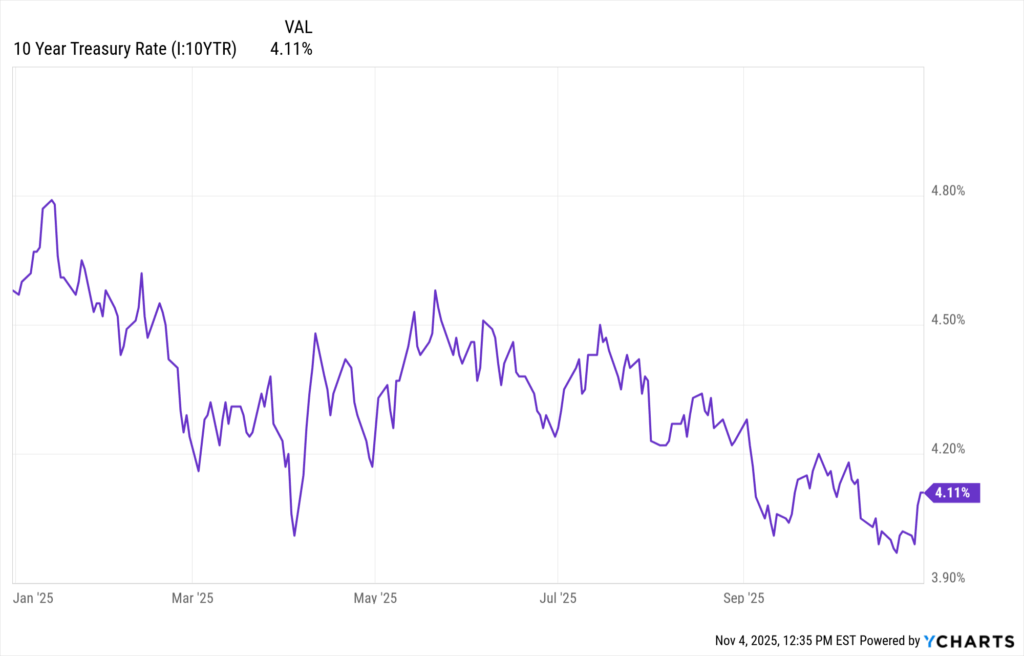

Interest Rates Declining- Interest rates have been on the decline in 2025 due to the FED reducing the Federal Funds Rate by ½ point so far in 2025, with another ¼ point expected in December. The 10-year Treasury Bond Yield has also declined significantly from 4.7% to the current 4.1%

The bond market, not the Federal Reserve (FED), determines the all-important 10-Year Treasury Yield. U.S. tariff revenue is approximately $350 billion annualized and reduces the amount of debt the Federal Government needs to issue to fund its deficit. The result: less bond supply + same bond demand = higher bond prices and lower yields. The 10-Year Treasury Yield directly affects mortgage rates, which, of course, affects the all-important housing market.

Putting all the “Media Noise’ to the side, stock prices are a function of earnings, earnings growth, and interest rates; and all three variables support the stock market at the current time.

However, concerns are present as always….

Our Concerns…

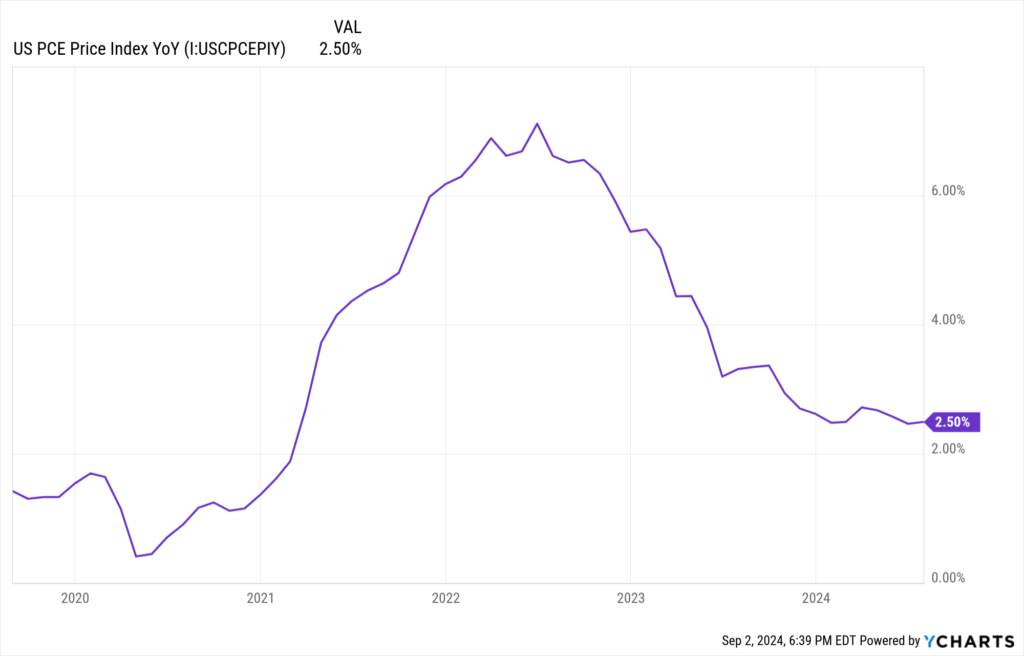

Inflation is above the FED 2% target, and the labor market is weakening, putting the Fed in a difficult position. The FED has the dual mandate to adjust monetary policy to achieve stable prices and full employment. Stable prices are defined as an inflation rate of 2.0% and full employment is defined as when unemployment is 4.0%. If the FED moves too quickly from the current “restrictive” monetary policy to a neutral policy, the economy may heat back up inflation while supporting the labor market. And conversely, if the FED holds interest rates at the current level, the labor market may continue to weaken. As a result, the FED affirmed its data dependency and provided a wait-and-see posture during the last FED press briefing.

While the FED uses all inflation indices to assess inflation, it gives the greatest weight to the Personal Consumption Expenditure Index. As the following chart illustrates, inflation has declined substantially, but remains above the FED’s 2.0% target and has increased slightly during the past few months due in part to tariffs affecting “goods” inflation.

The FED reduced the Fed Funds rate by ¼ point through its Federal Open Market Committee “FOMC” on October 29th. However, Chairman Powell stated that it is not a forgone conclusion that the FED will reduce rates in December as the market had previously expected. The bond market reflected this comment by selling short-term bonds to slightly increase interest rate expectations. Bond price interpolation estimates a 62% probability the Fed will reduce the Fed Funds rate by ¼ point in December 2025, down from 91% before Chairman Powell’s press conference on October 29th.

I believe it is possible that the Trump Administration “Administration” may ease off tariff rates in early 2026 if the PCE rate keeps rising to 3.0% up from the current 2.7%. The Administration will need kitchen table economic variables to be improving by summertime 2026 to maintain majorities in the House of Representatives and Senate; a challenging political feat. Historically, the President’s political party typically loses control of Congress during the midterm election cycle.

Supreme Court to hear oral arguments beginning Wednesday, November 5th, on two cases relating to the constitutionality of the executive branch enacting tariff policy rather than Congress. The two cases being heard are: Learning Resources Inc. et. al. v. Trump, which is being brought by small businesses challenging tariffs imposed under the International Emergency Economic Powers Act (IEEPA); and V.O.S. Selections, Inc./ v. Trump also challenges the Administration’s authority under the IEEPA.

If the Supreme Court rules against the Administration’s tariff authority, forcing a reversal in tariffs, the stock and bond markets will likely sell off. Tariff revenue is running at an annual pace of approximately $350 billion, reducing the amount of debt the U.S. Government needs to borrow to fund its operating deficit. In my opinion, this is why the U.S. Treasury bond yield has declined from 4.7% to the current 4.1% (see graph on page 2). If Tariff revenue is eliminated, the U.S. Government would need to issue additional bonds, which would drive up bond yields and thereby precipitate a stock market correction.

Rich Lawrence, CFA November 5, 2025

DISCLOSURE:

Opinions about the future are not predictions, guarantees, or forecasts. Investing in stock and bond markets has risks that could lead to investors losing money.