A brief recap of 2025:

2025 began with a positive outlook, with the average forecast for the US economy as measured by Gross Domestic Product “GDP” growing 2.0%, net of inflation. Interest rates were expected to decline by ½ point by the end of the year. The stock market rose 5% by the middle of February, then showed signs of weakness as concerns grew regarding tariffs. Then, on April 2nd, the administration announced sweeping, draconian tariffs, causing the Dow Jones Industrial Average “DOW” to decline 4,000 points in 3 trading days in early April. The Administration adjusted course, putting many of the tariffs on “pause”. During the following months, the Administration negotiated tariffs with most of the US’s trading partners; tariff concerns abated, and the stock market recovered. Many economists and market strategists started beating the “recession drum” in April and May; then in July, GDP and corporate earnings estimates began to rise.

The US stock market rose 9-13% in 2025, and the high-growth tech-heavy S&P 500 Index was up 16%.

2026 Outlook: We remain concerned with the financial situation of the lower-income cohort, most affected by the 20-25% upsurge in prices during the 2021-2024 period. The One Big Beautiful Bill “OB3” includes provisions that will benefit many in this cohort. Specifically, OB3 provides for no tax on tips, overtime, and social security with income phaseouts. Taxpayers benefiting from these tax exclusions will receive refunds in the first six months of 2026 due to over-withholding federal taxes in 2025. Additionally, those benefiting from the OB3 tax provisions will see their net pay increase in 2026 because of lower federal tax withholding requirements. Treasury Secretary Bessent estimates there will be $100-150 billion fiscal stimulus in the US economy in 2026 from OB3.

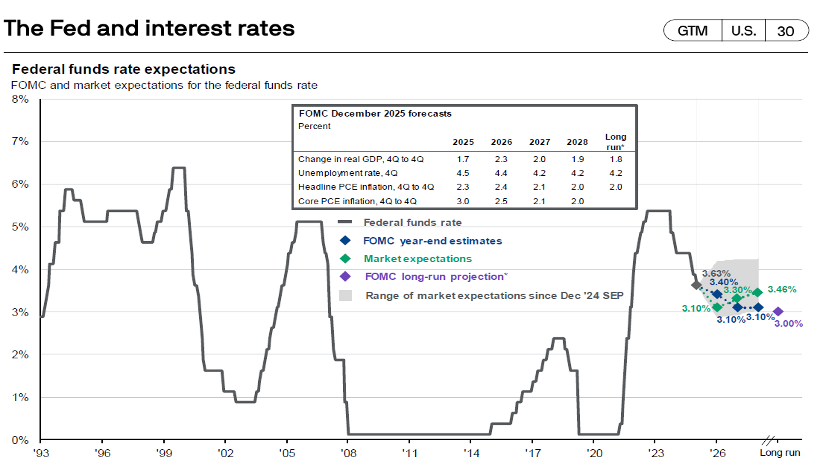

The Federal Reserve recently released its economic projections for 2026, which included a modestly improved outlook for 2026.

- GDP 2026: 2.3%; up from 1.8%.

- Unemployment Rate: by year-end 2026- 4.4%; no change.

- Inflation: for full year 2026- 2.5%, down from 2.6%.

- Federal Funds Interest Rate: by year-end 2026 – target range 3.25-3.50% – ¼ point cut from current 3.50-3.75%.

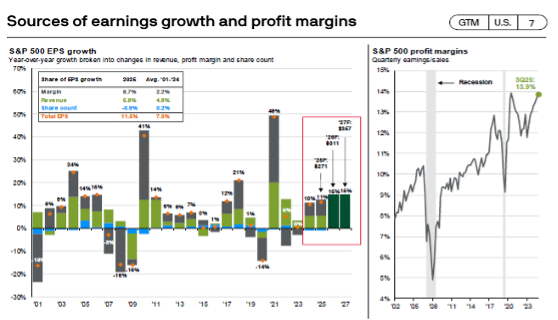

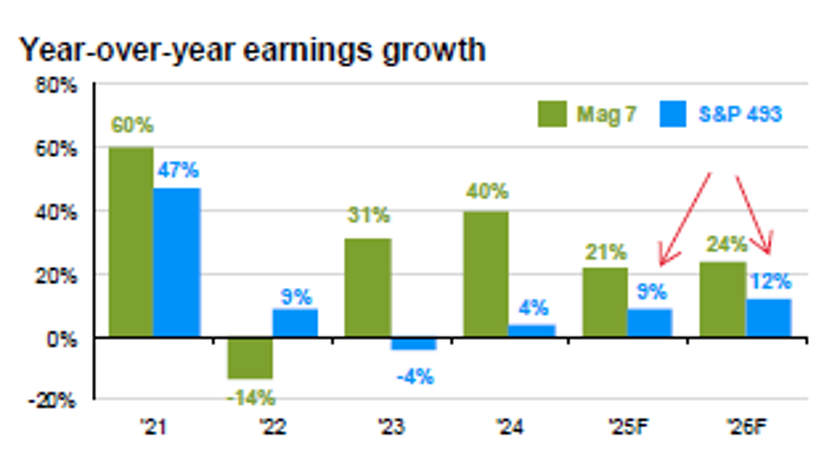

Corporate earnings are expected to rise 12-15% in 2026 and 2027, well above the approximate 7% historical annual average.

Corporate earnings among “non-magnificent 7 “stocks are expanding, providing more market breadth, in my opinion.

Interest Rates are expected to decline…

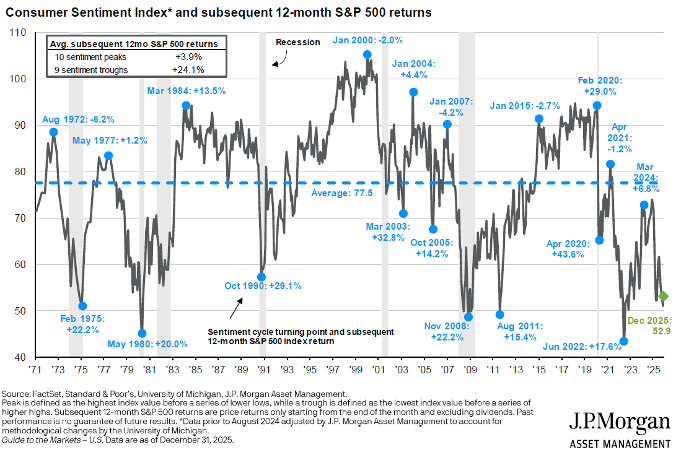

And finally, the counter indicator “Consumer Confidence” – consumers feel sour yet keep spending…

As the following chart illustrates, history shows that when consumer confidence is in a trough, the S&P 500 Index performs quite well during the ensuing 12 months. During the past 9 troughs, the S&P 500 Index average return was +24% during the subsequent 12 months. The one uncertainty is that we do not know when each trough is established until we look back. The current 52.9 reading is in the range of a historical trough, however…

2026 Market Outlook: Optimism with Discipline

In our view, the U.S. stock market is poised for another positive year, supported by strong corporate earnings growth, additional fiscal stimulus (estimated at $100–$150 billion), and lower interest rates.

A major driver of this outlook is the investment in Artificial Intelligence (AI). AI represents a technological revolution that should catalyze the economy to produce more with fewer inputs, expanding supply, improving productivity, and helping to keep inflation at bay.

Within AI, there are both “makers” and “users.” The initial phase of this cycle has focused on building the infrastructure – data centers, chips, and software. As this buildout matures, we believe the next stage will increasingly benefit the users of AI: companies that successfully integrate AI into their operations to gain efficiency, market share, and profitability.

History suggests that technological revolutions attract enormous amounts of capital, ultimately producing a handful of big winners alongside many losers. An interesting parallel comes from the early auto industry. Around 1900, roughly 200 auto companies existed in the U.S. By 1927, only 44 remained, and by 1950, just eight survived. Consolidation and bankruptcy were inevitable as the industry matured. We expect a similar pattern to unfold in AI.

Accordingly, we recommend that investors reduce, yet maintain, investments in AI “makers” while emphasizing a diversified portfolio of AI adopters or “users.” These companies should be better positioned to improve competitive advantages, expand margins, and deliver above-average long-term returns.

Our outlook is offered with humility. Economist John Kenneth Galbraith famously observed that “there are two types of forecasters: those who don’t know, and those who know they don’t know.” We place ourselves firmly in the latter camp.

While we remain optimistic about the U.S. economy and equity markets in 2026, we continue to advise clients to maintain a “safety bucket”- cash and investment-grade bonds sufficient to fund two to four years of anticipated cash needs. History teaches us that economic shocks are unpredictable in timing and cause. It also shows, time and again, the resilience, adaptability, and innovative strength of U.S. companies and entrepreneurs.

That balance of optimism paired with prudent risk management remains the foundation of our investment approach.

Rich Lawrence, CFA January 5, 2026

DISCLOSURE: Opinions about the future are not predictions, guarantees, or forecasts. Investing in stock and bond markets has risks that could lead to investors losing money. Lawrence Wealth Management and Rich Lawrence are not tax advisors. Before making any tax-related decisions, consult a licensed tax advisor.