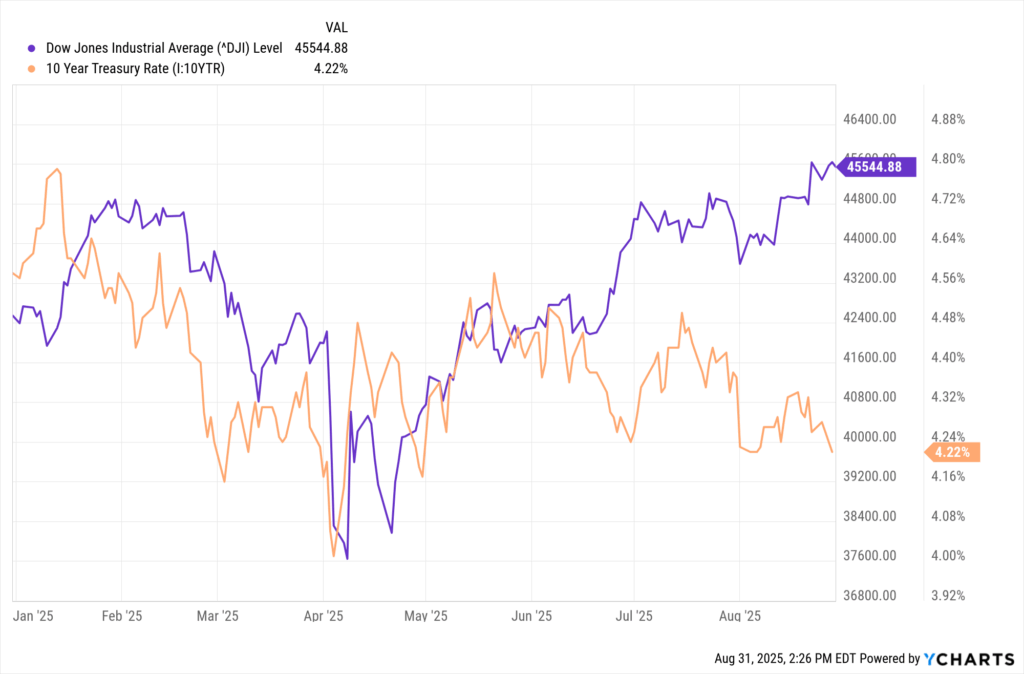

The main market news in August was the Fed Chairman Powell stating that the FED will likely reduce interest rates in September 2025. Every August, financial leaders from around the world gather in Jackson, WY, for the Jackson Hole Economic Policy Symposium. One of the highlights is when the US Federal Reserve Chairman (Powell currently) speaks about the US economy and monetary policy. Capital markets (bonds and stocks) listen intently to any potential change in monetary policy. This year, Chairman Powell gave the market what it was expecting, which is a confirmation that the FED would commence reducing the Federal Funds Rate in September 2025. While the market was expecting the FED to reduce the Federal Funds Rate in September 2025, hearing it directly from Chairman Powell was all the stock market needed for the Dow Jones Industrial Average to rise 845 points. As the graph below illustrates, the market is approaching its 2025 high and is up 7% on a year-to-date basis, and the 10-Year Treasury yield is 4.22%, down from 4.78% at the beginning of the year

The 10-year Treasury yield includes bond investors’ outlook for inflation and the outlook for the creditworthiness of the US. At the beginning of 2025, the bond market had concerns about inflation, and tax and tariff policy. As 2025 unfolded, the inflation rate declined, while still higher than the Fed’s 2% target. Tax policy is now known, and tariff policy, while still uncertain, is less uncertain than at the beginning of the year. Bond buyers became encouraged by these developments, driving bond prices up and yields down. Above-average corporate earnings growth and interest rates on the decline should support a rising stock market.

There are always concerns on the horizon as well:

· Geopolitical issues

· Inflation rising

· The labor market continues to weaken

A little trivia……Why did the Federal Government establish “Labor Day”? The first Labor Day celebration is traced back to 1882 in New York City, when the Central Labor Union issued an order to members to take the day off. By 1894, twenty-three states enacted laws to establish the first Monday in September as Labor Day. However, it was the political aftermath of the 1894 Pullman Strike that induced President Cleveland to sign legislation establishing Labor Day as a federal holiday. In May 1894, the Pullman Palace Car Company workers went on strike for better wages and working conditions. President Cleveland issued an injunction and sent federal troops to settle the strike because federal business was affected. Violence and bloodshed followed. Then, in June 1894, President Cleveland swiftly signed legislation to codify Labor Day to appease labor and cool down labor strife in the country.

Rich Lawrence, CFA September 1, 2025

DISCLOSURE:

Opinions about the future are not predictions, guarantees, or forecasts. Investing in stock and bond markets has risks that could lead to investors losing money.