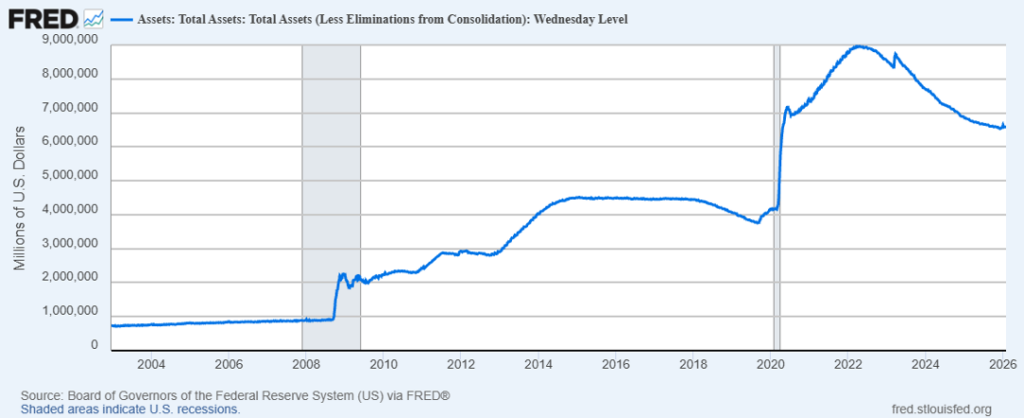

The President nominated Kevin Warsh to be the next Chairman of the Federal Reserve. Kevin Warsh has an impeccable record of experience in the private sector, academia, and the public sector in both the federal government’s executive branch and as a Governor of the Federal Reserve “FED”. Warsh has long maintained that the Federal Reserve’s primary responsibility is to preserve price stability by limiting excessive growth in the money supply. He has been a consistent and outspoken critic of the Fed’s expansion of its balance sheet during periods of economic growth and prosperity, arguing that such policies distort capital markets and encourage fiscal irresponsibility. At the same time, Warsh has acknowledged that the Federal Reserve has a legitimate and necessary role as a provider of liquidity to the financial system during periods of crisis. He supported extraordinary interventions during the 2008–2009 financial crisis and the sharp economic contraction triggered by the COVID-19 pandemic, when financial markets faced acute stress.

In my opinion, the Federal Reserve’s accommodative policies over the past decade have effectively underwritten the federal government’s profligate spending. I believe Warsh will guide FED policy to reduce its balance sheet. Kevin Warsh resigned from his Federal Reserve Governor position in 2011 because he disagreed with FED policy of QE2 (QE-quantitative easing, i.e., printing money) and QE3 during 2010-2014. This is evidence, in my opinion, that he will guide the Federal Open Market Committee “FOMC” to deliberately reduce the FED balance sheet without disrupting the capital markets.

Let’s follow the money. Congress passes a spending budget that the President signs into law. The US Treasury then issues bonds, which the FED purchases with printed dollars that the US Treasury spends. The result is an immediate money supply infusion into the economy, and the FED’s balance sheet increases. While the federal government typically “goes big” to rescue the economy during crises, it has not paid down these borrowed funds by cutting expenses or increasing taxes to pay off debt that financed economic recoveries. The result is an ever-expanding national debt. The time has come to bring fiscal discipline to federal spending and to limit money supply growth by the FED.

Markets were pleased with the Warsh announcement as gold sold off 8%, silver sold off 28%, and the US dollar rose a modest 1%. My view is that capital markets are encouraged by the Warsh nomination, but taking a wait-and-see approach. The chart below illustrates the FED’s balance sheet during the past 20 years.

Was this money supply increase needed? (graph below)

We do not think so!

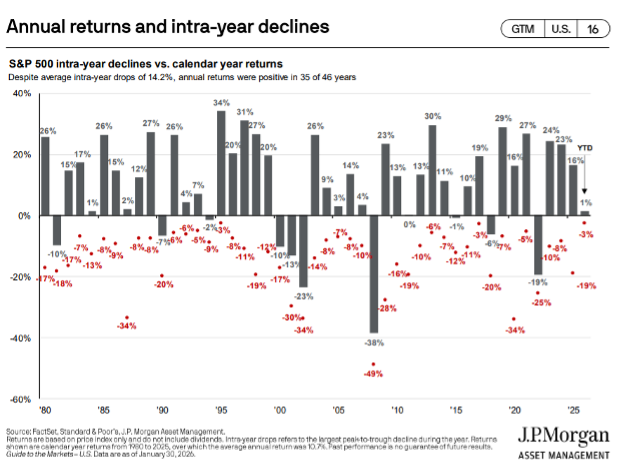

Is the stock market due for a pullback? Yes, as usual- 6-8% or 3,000 to 4,000 Dow Jones points. Typically, the market pulls back 6-8% from the market’s intra-year high most years. This is not to initiate any undue fear, but rather to acknowledge the market is volatile on both the up and downside and pulls back 6-8% in most years.

Corporate earnings are expected to increase 12-14% annually in 2026 and 2027, and interest rates are expected to decline modestly in 2026, both of which are positive catalysts for the market. However, we are realists and know that unforeseen events can arise to cause market selloffs and rotations within the market.

The graph below illustrates clearly the market’s returns and annual intra-year declines.

While we remain optimistic about the U.S. economy and equity markets in 2026, we continue to advise clients to maintain a “safety bucket”—cash and investment-grade bonds sufficient to fund two to four years of anticipated cash needs. History teaches us that economic shocks are unpredictable in timing and cause. It also shows, time and again, the resilience, adaptability, and innovative strength of U.S. companies and entrepreneurs.

The balance of optimism paired with prudent risk management remains the foundation of our investment approach.

Rich Lawrence, CFA February 4, 2026

DISCLOSURE: Opinions about the future are not predictions, guarantees, or forecasts. Investing in stock and bond markets has risks that could lead to investors losing money. Lawrence Wealth Management and Rich Lawrence are not tax advisors. Before making any tax-related decisions, consult a licensed tax advisor.